Tayo Busayo, Abuja

DAILY COURIER - In a strategic move to strengthen Nigeria's foreign reserves and stabilize the economy, the Federal Government has introduced a nine-month dollar deposit initiative, allowing citizens to deposit dollar cash into their bank accounts without incurring taxes or penalties.

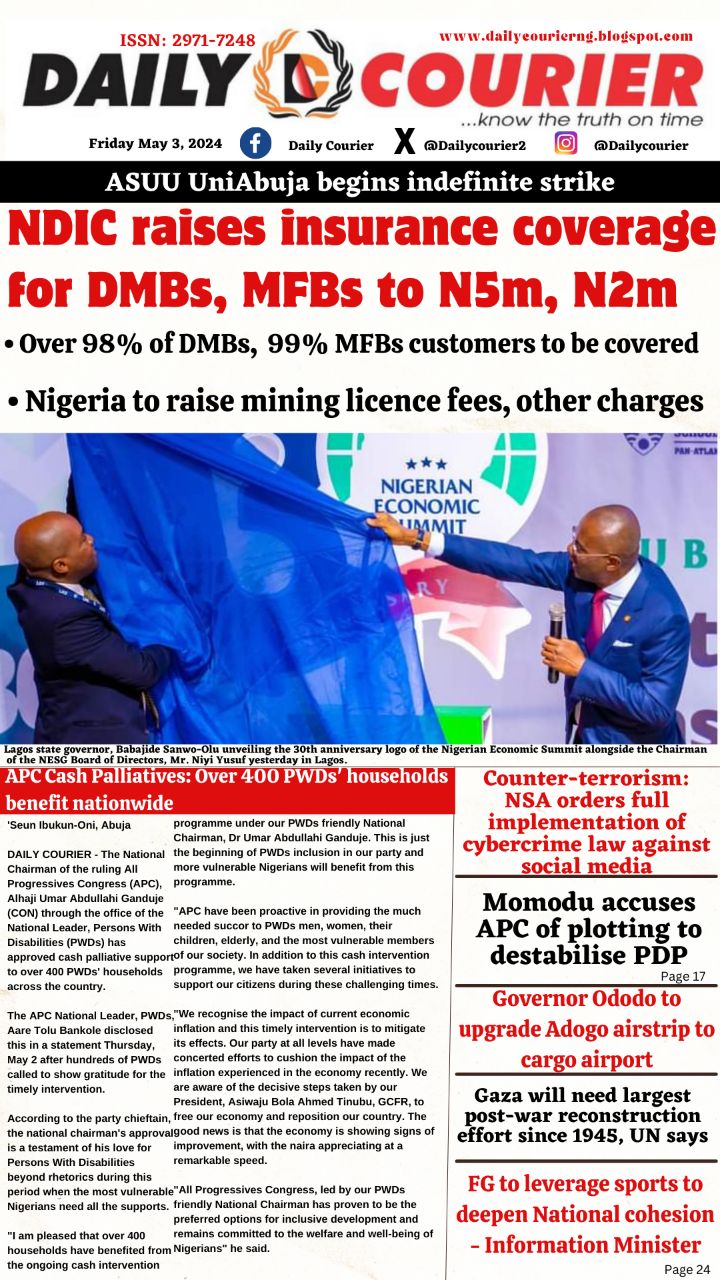

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, announced this after a National Economic Council (NEC) meeting on Thursday, chaired by Vice President Kashim Shettima at the Presidential Villa, Abuja.

The initiative, effective immediately, was launched in collaboration with the Central Bank of Nigeria (CBN) to encourage citizens holding foreign currency outside the formal banking system to safely deposit these funds in their bank accounts. Edun emphasized that the programme is aimed at those with legitimate funds, with banks required to verify sources under Know Your Customer (KYC) protocols.

“This initiative offers a safe, compliant path for Nigerians holding dollar cash to deposit these funds into their bank accounts, which will add to our reserves and potentially ease pressures on the exchange rate,” Edun said, highlighting that the initiative aligns with ongoing economic reforms under President Bola Tinubu’s administration.

During the NEC meeting, Edun updated the council on the government’s comprehensive economic reform efforts, which seek to address persistent inflation, sluggish growth, and significant public debt.

President Tinubu's administration has moved to eliminate costly subsidies on petroleum and foreign exchange, a reform expected to save $15-20 billion annually, equivalent to about 5% of the national GDP. These reforms, while potentially stabilizing the economy long-term, have resulted in higher living costs for Nigerians.

To mitigate the impact on vulnerable populations, the government has launched a series of support programs, including a new minimum wage initiative and direct payments to households registered on the social welfare platform. According to Edun, approximately 5 million households, representing around 25 million Nigerians, have received financial assistance through these programs, verified by biometric identification to ensure transparency and accountability.

Edun outlined a series of measures aimed at further supporting Nigerians amid rising costs:

- Consumer Credit Scheme: Over N3.5 billion has been disbursed to 11,000 workers to access affordable loans.

- Student Loan Scheme: With over half a million beneficiaries, this interest-free loan program has distributed N90 billion to students and educational institutions.

- Food Security and Agricultural Support: In response to food inflation, the government has approved duty-free imports of brown rice to address a 2.5 million metric ton shortfall. Additional subsidies on fertilizer, herbicides, and seeds aim to bolster domestic wheat and rice production in the upcoming dry season.

The economic reforms include a shift in local refinery payments, which now require Naira payments for crude oil, allowing petroleum products to be sold domestically in Naira. This change, along with market-based pricing for petroleum and foreign exchange, has generated approximately N700 billion monthly for the Federation Account, with funds earmarked for critical public investments.

In addition, small and micro-enterprises are receiving targeted support through low-interest loans, with N50 billion allocated as grants for entrepreneurs needing working capital.

Edun conveyed that these reforms, despite challenges, are essential steps to build a more resilient economy. “These reforms represent a continuous effort to address the high cost of living and strengthen Nigeria’s economic foundation,” he said, reaffirming the government’s commitment to maintaining social welfare while building an environment conducive to sustainable economic growth.

The new dollar deposit initiative, part of this broader fiscal strategy, aims not only to enhance foreign reserves but also to foster public confidence in the banking sector and provide greater economic stability as Nigeria navigates a complex global economic landscape.